On This Page: [hide]

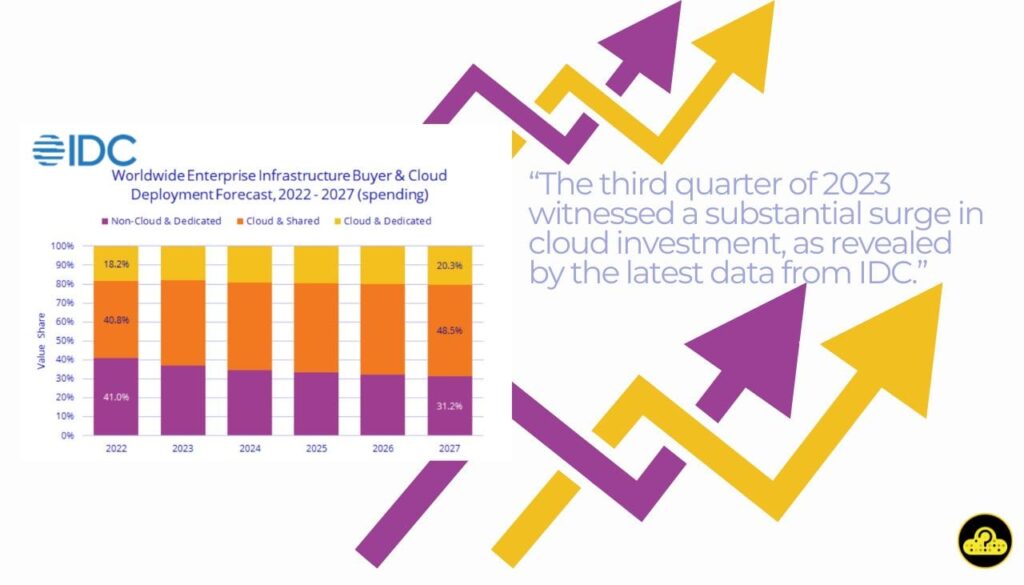

The third quarter of 2023 witnessed a substantial surge in cloud investment, as revealed by the latest data from IDC. The report, titled ‘Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment,’ unveils a remarkable 2.9% year-over-year increase, totaling $25.4 billion, in spending on compute and storage infrastructure products specifically designed for cloud deployments.

This surge in cloud infrastructure spending stands in stark contrast to the non-cloud segment, which experienced an 8.2% decline, dwindling to $14.9 billion in the same quarter. According to IDC, the momentum toward cloud is propelled by the demand for handling more complex workloads and supporting emerging AI initiatives.

Juan Pablo Seminara, Research Director at IDC, emphasizes that despite economic and socio-political challenges, the outlook for 2024 remains positive. Cloud-based spending is anticipated to rebound at a double-digit pace throughout the year, showcasing the industry’s resilience and adaptability.

The report also notes the substantial growth in shared (public) cloud infrastructure, reaching $18.5 billion in the quarter, marking a 7.2% increase from the previous year. This category continues to dominate the infrastructure spending landscape, constituting 45.9% of total spending in Q3 2023. In contrast, the dedicated (private) cloud infrastructure segment experienced a 7.2% year-over-year decline to $6.9 billion.

Cloud Spending by Service Providers

Looking ahead, IDC forecasts a 9.7% growth in cloud infrastructure spending for 2024, totaling $100.6 billion. In comparison, the non-cloud infrastructure segment is expected to face a 7.7% decline, reaching $58.7 billion. Shared cloud infrastructure is projected to experience a robust 13.9% year-over-year increase, reaching $72.2 billion, while spending on dedicated cloud is expected to remain relatively flat with a 0.3% growth.

The report delves into the spending behavior of service providers, encompassing cloud service providers, digital service providers, communications service providers, hyperscalers, and managed service providers. In Q3 2023, this group invested $24.9 billion in compute and storage infrastructure, reflecting a 1.7% increase from the previous year and representing 61.7% of the total market. In contrast, non-service providers, including enterprises and government entities, reduced their spending to $15.4 billion, a decline of 6.3% year over year.

Geographic Variances

Geographically, cloud spending in Q3 2023 yielded mixed results. Negative growth was observed in Canada, Central & Eastern Europe, Western Europe, the Middle East & Africa, and Latin America due to various regional challenges. Japan, China, Asia/Pacific (excluding Japan and China), and the United States experienced growth, with increases in cloud spending of 16.0%, 15.5%, 10.0%, and 0.9% respectively.

This regional disparity reflects the varying impacts of global challenges, such as the Russia-Ukraine conflict affecting Central & Eastern Europe and high energy prices and tight economic conditions influencing Western Europe. Meanwhile, regions like Japan and China have shown robust growth, indicating a strong adaptation to cloud infrastructures in these markets.

Long-Term Forecast: A Bright Future for Cloud Infrastructure?

IDC’s long-term forecast paints an optimistic picture for the cloud infrastructure sector. The compound annual growth rate (CAGR) for global spending on cloud infrastructure is predicted to be 10.6% over the 2022-2027 forecast period. By 2027, the expenditure is expected to reach $152.0 billion, constituting 68.8% of the total compute and storage infrastructure spend.

Shared cloud is projected to dominate this spending, accounting for 70.5% of the total cloud expenditure, growing at an 11.1% CAGR to reach $107.1 billion. Dedicated cloud spending is expected to grow at a 9.7% CAGR, amounting to $44.9 billion.

In contrast, non-cloud infrastructure spending is projected to remain relatively stable, with a modest 1.6% CAGR, reaching $68.9 billion in 2027. The spending by service providers on compute and storage infrastructure is expected to grow at a 10.4% CAGR, reaching $148.9 billion by 2027.

Conclusive Thoughts

These cloud industry statistics showcase the ongoing shift towards cloud-based solutions in the enterprise infrastructure landscape. The growth in cloud spending, particularly in shared cloud infrastructures, reflects a broader trend towards digital transformation, supported by the need for scalable, flexible, and efficient IT solutions.

Since businesses navigate various challenges and embrace new technologies like AI, the reliance on cloud infrastructure is expected to increase. In conclusion, IDC’s report not only provides a snapshot of the current state of enterprise cloud infrastructure spending but also offers a glimpse into the future trends of the IT industry.